James Montier, one of my favourite strategists and market commentators, formerly from SG, is now working for GMO. Now that is very convenient for me, since I can now access two of my favourite commentators and strategist from one website! That is just a side comment though, since what I wanted to write about today, is the latest commentary from Jeremy Grantham in his quarterly letter for 1st Q 2010. The link is here.

He has some excellent comments and discussion about the Graham and Dodd crowd and their investment strategy, which makes the read worthwhile on its own. But what has struck me, was their research into financial bubbles. His big point is the fact that ALL bubbles revert back to trend, as was the case for the previous 32! He makes special mention of the still existing UK and Australian housing bubbles and how they still defy their inevitable 40% decline back to trend because of artificial stimilus by their Governments.

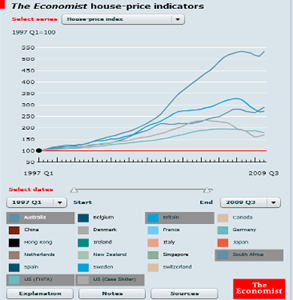

This of course had me wondering where we in SA stood as regards to our housing market, and today I read an article where they discuss the housing bubble in the UK and Australia compared to the US. This led to an interactive chart from “The Economist” where you can chart the relative house price increases over time.

The interactive chart at the Economist can be viewed here. As you can see, if the UK and Australia house market are regarded as being in “bubble” territory, then I don’t know how they will define SA’s right at the top!