A few years ago when I mentioned to a friend, who is also a well known professional assetmanager, that I manage the money of my sister as well, he exclaimed that I should not do such an irresponsible thing ! I told him at the time that I do not see any reason why not, as I was ( maybe a little bit naively ) confident that I could outperform the professionals and the indexes over time.

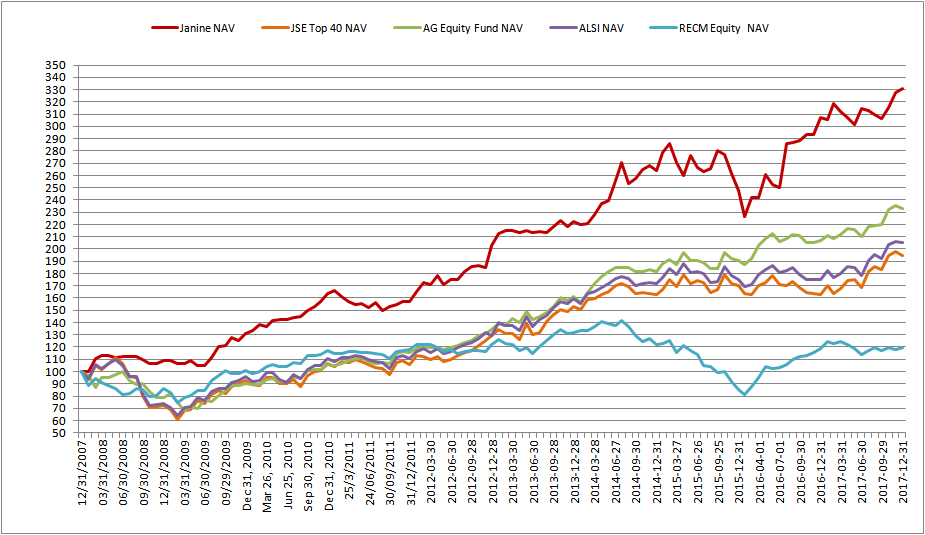

Ten years have now passed since I made that commitment to my sister, and the above graph is the result of my effort over that time. Each R100 invested by her in her brokerage account have grown to R331-10 for a 12.72 % compound annual rate of return (CARR). This compares to the R233 her money would have been worth had she invested all of it in the Allan Gray Equity Fund which was one of the top performing funds at that time, or the R119 had she invested in the RE:CM Equity Fund which was also touted as a “rock star” performer fund in the media at the time. Had she been able to invest in the ALSI Index directly (without fees !), her money would have been worth R205 for a CARR of 7.47% .

I hope she is happy with this performance, as personally I think I could have done better, was it not for a few mistakes and lost opportunities along the way. I have also never had her cash position under 30% at all times, which is very conservative, especially considering that I measure my performance against pure equity funds and indexes which tend to outperform cash returns considerably over a time horizon of 10 years.

Let’s see what the next 10 years bring. I am excited for the future as I think I am just getting better, more knowledgeable, more experienced and more diversified with alternative strategies I have learned to implement. It is all very hard work though, but I am committed to stay humble, to keep reading , and learning from others . I love doing this and there is nothing else I would rather do !

Happy new year and good luck in the markets !

Good day Albie

I’m very impressed with your performance and the simplicity of your writing. If you don’t mind me asking, what philosophy do you use?

I’m coompiling a website of my own that tracks my investment journey and I follow a value approach but have been enjoying learning across all styles and stories.

You noted as well that you’re a professional asset manager, hopefully it forms a basis for future conversations as I’m interested in one day owning my own asset management firm. I’m currently doing my CTA.

Thank you for your time and good regards

Dear Lesegisha

Thank you for your kind words and taking the time to comment.

For the record, I am not a professional asset manager in the sense that I manage other people’s money for a fee. I manage mostly my own money and that of friends and family members. I have done this for many years now and my investing style is mostly long term value orientated, although I am willing to invest in short term arbitrage opportunities as well.

Best of luck with your career and studies. Investing is a life long journey of learning.

Kind regards

Albie

Thank you for your prompt response Albie.

Your family is very fortunate considering often all that is needed is the one person that bucks the trend for them to be making great returns. The person that asks Why, why not, why not me. Your confidence is inspiring all the more that you don’t do it in a suit, tie and lies environment.

I watched the video on Arithmetic, population and energy and it’s always sobering to see how far the basics and logic of any subject can take you. In this instance a preparedness that really benefits those around you.

Your long term value orientation, is that Ben Graham? Peter Lynch? Phil Phisher?

Thank you once again