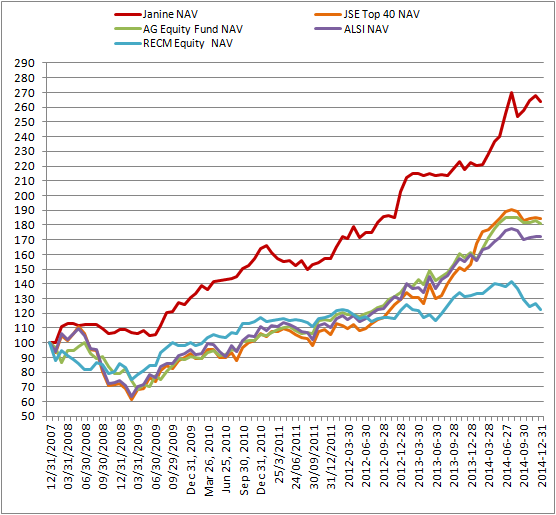

In most cases a picture tells more than words can. However, it is sometimes insightfull to know the facts and story behind such picture. This is the graph of the investment portfolio than I have managed (for free for now) for my sister the last 7 years. She has always had her money invested with Allan Gray since many years ago when I advised her that I think they were some of the top money managers in SA at the time. A few years back I said to her that I think I can do better, but did not have the confidence, or the verified track record yet, to ask her to entrust all her investment money to me. So I said she must devide all her savings, existing and future, 50/50 between AG Equity fund and her own share portfolio, which I would manage for her, in the same manner as I do my own funds. She will own the investment account in her own name and have 100% access to it to see exactly what is going on and where the money is at all times.

Every year this time I write a short “report” for her on how her investments performed vs some of the well regarded professional money mangers in SA, as well as vs the Equity Indexes. I always experience a little bit of anxiety beforehand, mainly because before I do the numbers, I don’t actually know how I have done, since I do not keep score throughout the year. I hope I have not disappointed her up to now, and she has not fired me yet, so she must be happy. I am only joking though, as my sister is the perfect “client” who never bothers me during the year regarding her investments, which allow me the discretion to do things as I want, and as I do with my own money.

For 2014 her portfolio grew by 18.7 % . The JSE ASLI-index was up by 7.6% and the TOP40-index by 6.5%, so an 11-12% outperformance. I have to mention though that I don’t think I have ever gone below 30% cash levels the last few years and the avg cash position in her portfolio was probably around 40 – 50 %. So my “benchmarks” is probably a stretch considering the 100% equity of the index and some of the Equity Unit trusts. I think I am very conservative in nature and did not see too many “sure bets” in the market.

I also benchmark against 2 professional money managers whom I hold in high regard and have a lot of respect for, Allan Gray and Piet Viljoen of RE:CM. The AG Equity fund was up 12.2 % in 2014 and the RE:CM Equity fund down 7.5 %. Looking back at the last 7 years, her portfolio performance was more than double that of the indicies and the professional money managers. So all in all I think a satisfactory outcome up to now. My aim is to have a full 10 year period to evaluate against. Lets see what 2015 holds.